Tuesday, 21 March 2023

Lido’s Staked Ethereum Token STETH Reaches $10.3B Market Capitalization, Ranks Ninth by Market Valuation

by Earn Media

With the crypto economy experiencing significant gains over the past week and the price of ethereum rising 11.9%, the market capitalization of Lido’s staked ether has increased to $10.3 billion. This recent increase has propelled the token’s overall market valuation to the ninth-largest position, according to the crypto market capitalization aggregation website coingecko.com.

Lido Finance’s TVL Dominates Defi with a 21.59% Share

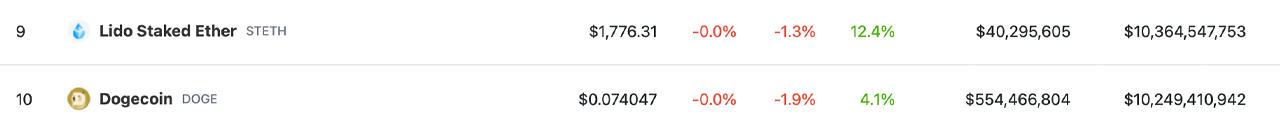

The value of liquid staking tokens associated with ethereum (ETH) has increased significantly over the last week following ether’s 11.9% gains against the U.S. dollar. In particular, Lido’s staked ethereum token, STETH, now has a market capitalization above the $10 billion range, reaching $10.36 billion on Monday, March 20, 2023. According to coingecko statistics, STETH’s market valuation now ranks ninth, with dogecoin’s (DOGE) market capitalization holding the tenth position.

Above STETH is the market valuation of polygon (MATIC) at $10.42 billion. Currently, there is a circulating supply of around 5.8 million STETH, and over the past 24 hours, the token has recorded $22.35 million in global trades. The most active exchanges dealing with STETH on Monday are Bybit, Gate.io, and Huobi. STETH has gained 12.4% this week and 4.6% over the past 30 days.

Currently, Lido Finance’s website estimates that STETH stakers are receiving around a 5.9% annual percentage rate (APR) by staking the token. At the time of writing, Lido is the largest decentralized finance (defi) protocol out of the $49.01 billion total value locked (TVL) on Monday. Lido’s TVL accounts for 21.59% of the entire amount of value locked in defi. In the last seven days, defillama.com statistics show that Lido’s TVL has increased by 8.9%, and over 30 days, it has grown by 17.07%.

Defillama.com explains that on Monday, 7.83 million ETH worth $13.98 billion is staked in liquid staking protocols today. Lido’s STETH represents 74.51% of the aggregate. Coinbase’s Wrapped Ether token protocol has $2.1 billion in total value locked, or 1.16 million Ethereum. It is the second-largest liquid staking project in terms of TVL.

While STETH is shown on coingecko.com as the ninth-largest coin by market cap, this is not the case with other crypto market aggregation sites like coinmarketcap.com. Because it’s a synthetic version of Ether, some crypto market aggregation sites do not include STETH in the top ten, despite its capitalization size.

What are your thoughts on the increasing market capitalization of STETH and its role in the growing liquid staking ecosystem? Do you think STETH will continue to climb up the rankings of the top cryptocurrencies? Share your thoughts about this subject in the comments section below.