Thursday, 9 January 2025

Fund manager who forecast Nvidia’s rally makes surprising move after CES keynote

by BD Banks

“The ChatGPT moment for general robotics is just around the corner,” Nvidia just said at CES.

Investors, however, weren’t impressed.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

Nvidia (NVDA) shares tumbled roughly 6% on Tuesday, marking the biggest drop in months, after they’d touched a record $153.13.

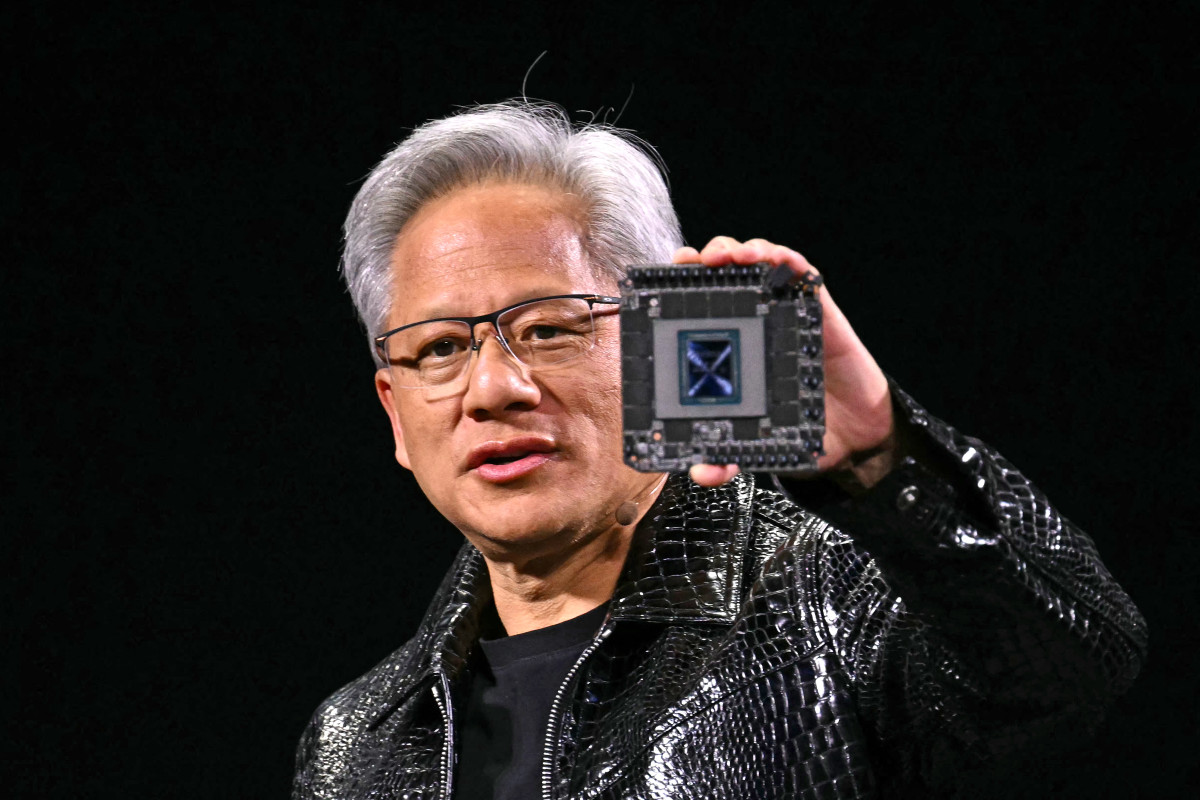

The decline followed CEO Jensen Huang’s keynote at the tech industry’s annual Consumer Electronics Show in Las Vegas, where he unveiled the next big wave of artificial intelligence.

While Huang’s vision for AI sparked gains for other tech stocks like Marvell (MRVL) , it wasn’t enough to sustain Nvidia’s rally, as investors probably expected more from the No. 1 company in the AI industry.

Here’s what Nvidia said at CES

One of the biggest news at the event was Nvidia’s progress in robotics and industrial AI.

Huang highlighted the company’s new Cosmos platform, a foundation model designed to enable more efficient development of physical AI for the robotics industry, further expanding Nvidia’s reach into AI for business.

Related: Micron stock leaps following Nvidia CEO Jensen Huang’s CES reveal

So far, Tesla (TSLA) has dominated the spotlight in robotics, but that might be about to change. Analysts say this could mark the ChatGPT moment for the entire industry and further cement Nvidia’s position as a leader in AI.

Huang also mentioned that Blackwell, its current flagship chip platform, is in full production, but he did not talk about Nvidia’s next-generation design on chips following Blackwell — an update many investors are eagerly awaiting.

“Many investors were hoping for more concrete progress updates on the ramp of Blackwell and some input as to the company’s progress with its next-generation GPU platform, Rubin,” Benchmark Research analyst Cody Acree wrote in a note, MarketWatch reported.

“There was zero mention of Rubin, although to be fair, this next-generation design is not expected until 2026.”

Veteran portfolio manager sold Nvidia shares

Chris Versace, a veteran portfolio manager for TheStreet Pro, sold some of his shares in Nvidia after the move higher.

Versace’s career began in the 1990s. He first bought NVDA shares last February in TheStreet Pro’s portfolio, and added to the position five times, with the last one in May.

His average gain on Nvidia shares is nearly 70%.

Related: Tech heavyweight launches AI chips that can compete with Nvidia

On Jan. 7, Versace sold some 8% of his Nvidia holdings at $144.54 per share. He also trimmed 7.6% of his Marvell stake at $116.31 a share.

Following the sales, each of the two stocks accounts for about 4% of TheStreet Pro’s total portfolio.

Versace said Huang’s speech was “triggering some prudent portfolio management on our part, which also happens to lock in a slice of tremendous gains in both positions given their gains since bottoming in early August.”

Nvidia stock has gained about 50% since last August, while Marvell has nearly doubled.

“We culled back the position sizes by less than 10% of the overall position size. The why behind that is we recognize there is more room to run, but we don’t want to be overly exposed especially after such a big run in both stocks,” Versace added.

Analysts from Bank of America share that opinion, that NVDA shares might have more room to grow.

More Tech Stocks:

- 5 quantum computing stocks investors are targeting in 2025

- Fierce technology battle erupts within Donald Trump’s fanbase

- 5 potential tech IPOs that may supercharge markets in 2025

The investment firm affirmed a buy rating and $190 price target on Nvidia and continues to identify the stock as the firm’s “top sector pick” after Nvidia’s CES keynote.

“Nvidia continues to expand its well-optimized and targeted lineup of AI services for enterprise customers,” said Bank of America analyst Vivek Arya.

Nvidia closed at $140.14 on Jan. 7.

Related: Veteran fund manager delivers alarming S&P 500 forecast