Friday, 19 May 2023

Can AI Power Nvidia Stock to All-Time Highs?

by Earn Media

Nvidia (NVDA) – Get Free Report shares continue to fly, rallying almost 10% this week and currently riding a four-day winning streak.

It’s got the tech bulls fired up: Nvidia has become the de facto leader of this year’s market rally. Meta (META) – Get Free Report has been impressive, too, but no megacap tech stock has run quite like Nvidia has in 2023.

Nvidia stock has more than doubled (up 113%) this year. At one point, Tesla (TSLA) – Get Free Report was in the mix as well, but the electric-vehicle producer’s stock has struggled a bit the past few months. It’s still up more than 40% for 2023, but the clear leader has been Nvidia.

Don’t Miss: Starbucks Momentum Has Waned; Here’s Where to Buy the Dip

The graphics-chip stalwart’s stock seems to have gotten a super boost because it is exposed to the AI trend.

Now that Nvidia sports a market cap of roughly $770 billion, the talk will likely shift to whether it can run back to its all-time highs. Eventually, investors may speculate whether it will join the $1 trillion market-cap club. To get there would require a rally of 30% from current levels.

While that seems like a big move, it’s not that wild considering how the stock has performed so far this year.

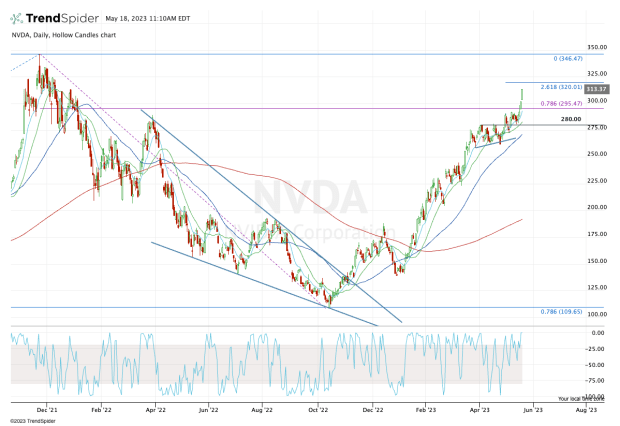

Earlier this month, we looked at Nvidia’s breakout over $280. Now that it’s powering over $310, let’s take an updated look at the charts.

Trading Nvidia Stock

Chart courtesy of TrendSpider.com

The way the semiconductor stocks have traded lately, it’s no wonder that Broadcom (AVGO) – Get Free Report has broken out as well. And with the way Nvidia is trading, I’m not sure what will slow it down.

When we look at the charts, the initial breakout over $280 wavered, but the stock was able to regain this level and hold it as support. Then Nvidia stock powered through short-term resistance in the low-$290s before exploding through the 78.6% retracement and the $300 level yesterday.

From here, not much is standing in the way of a further run for Nvidia, at least not from a technical perspective.

One could note the 261.8% extension level from the first breakout attempt over $280. That level comes into play near $320. Above that mark and the $330s could be on tap before an eventual attempt to test to the all-time high up near $346.50.

That would be a gain of about 10% from here. Bulls would need to see a move above $400 for the calls for a $1 trillion market cap to heat up.

Don’t Miss: Trading Cathie Wood’s ARKK as It Tries to Break Out Over Resistance

Nvidia is a good lesson for traders.

First, patience is required. This move has been monstrous but has taken time. Two, despite all the macro fears and scary headlines, traders who focused solely on their analysis would have been long Nvidia, not short.

I don’t know when Nvidia stock will hit new highs, but if the momentum continues the way it has, it won’t take long. That said, “risk management” is a huge component to successful trading, so traders should be taking profits and raising their stops along the way.

On the upside, see how it handles $320, then the $330s. On the downside, keep an eye on the low-$290s to $300 zone.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.